When it comes to achieving Financial Independence and Retiring Early (FIRE), building a balanced and diversified portfolio is crucial. My overarching goal has always been to keep things as hands-off as possible so I can focus on living a well-rounded life rather than constantly monitoring investments.

I certainly didn’t arrive at this approach in one step. Early on, I found myself dabbling in broad-market ETFs (like VTI) and gold funds (such as GLD) without a cohesive plan or a clear end goal. Over time, however, the Bogleheads philosophy—shaped by Jack Bogle and popularized by JL Collins—introduced me to low-cost index funds, broad diversification, and a set-it-and-forget-it mindset. It was a game-changer, and I started using a core Three-Fund Portfolio.

Eventually, I realized there might be more ways to diversify beyond just stocks and bonds, so I introduced real estate (via REITs). Around that time, I also discovered risk parity concepts—championed by folks like Frank Vasquez—which emphasize uncorrelated asset classes to smooth out returns. By marrying these ideas with my Bogleheads foundation, I ended up with a portfolio I consider relatively balanced and largely hands-off.

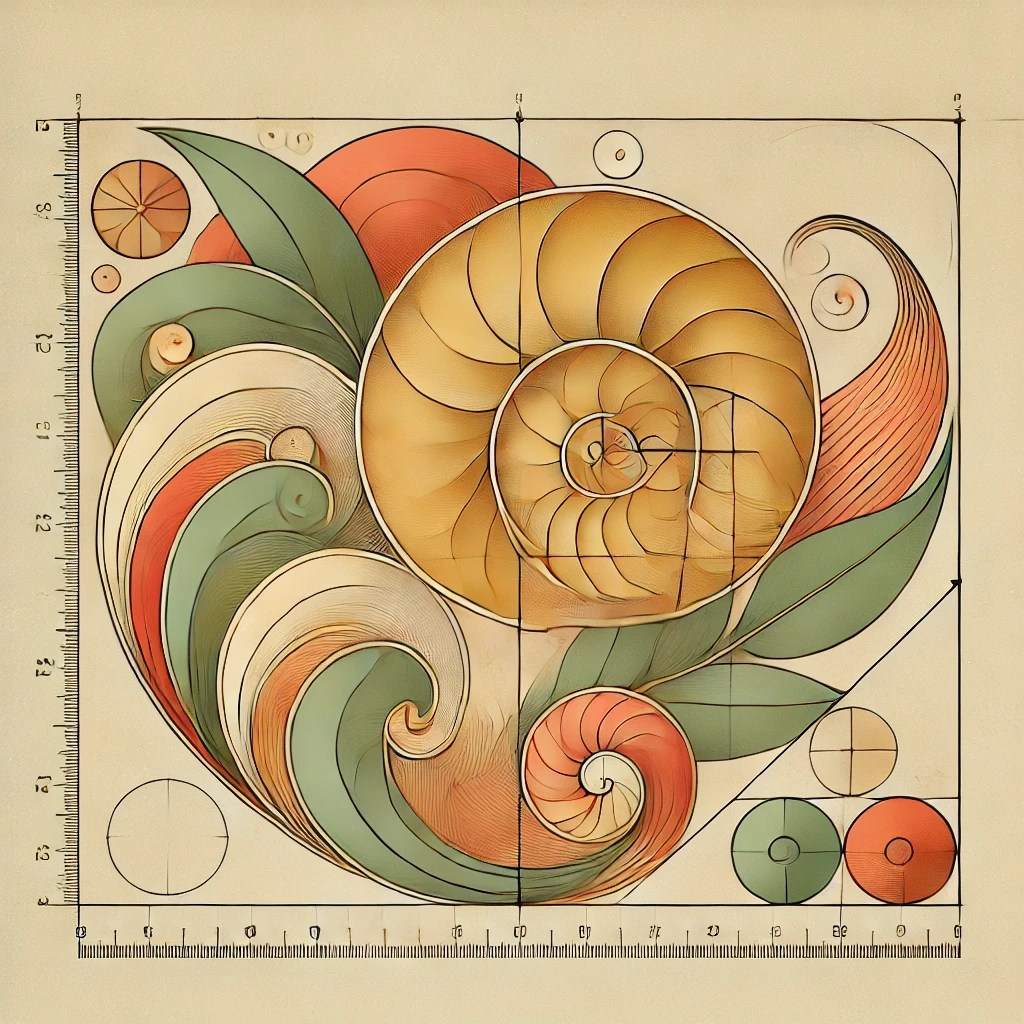

Another guiding principle for me is leaning heavily on low-cost index ETFs instead of individual stocks or actively managed funds. I’ve found that sticking to simple, broad-based investments keeps fees low and frees me to focus on bigger life goals. Lately, I’ve also begun working toward what is called a “Golden Ratio” allocation—distributions of roughly 6%, 10%, 16%, 26%, and 42%—because as an engineer and math enthusiast, I’m drawn to how the Golden Ratio (approximately 1.62) appears everywhere from the Fibonacci sequence to patterns in nature.

Below are five main asset classes that define my current strategy. Correlations will sometimes spike during extreme market events, but my hope is that this structure lets me manage risk and pursue growth without consuming too much of my time.

1. Stock Market (U.S. + International)

Asset Class Overview: I bundle my U.S. and international equities into a single “Stock Market” category. In my mind, these cover a broad range of companies across sectors and regions, aiming to capture global economic growth. The U.S. market has strong regulatory oversight and a legacy of innovation, while international markets offer exposure to different economic cycles and opportunities in emerging regions.

Diversification Benefit: Even though global markets have become more interlinked in recent years, I still see some advantage in spreading my equity investments across multiple continents. This means I’m not overly reliant on any single country’s fortunes.

Risk & Correlation Notes:

- Risk: Equity investments can swing widely in response to economic changes, geo-political events, interest rates, and market sentiment.

- Correlation: U.S. and international stocks can still move in tandem at times, but they often diverge enough to provide at least some diversification benefit.

My Current Choices:

I prefer low-cost index funds or ETFs for simplicity (e.g., combining Vanguard Total Stock Market for U.S. (VTI) with Vanguard Total International (VXUS), although Fidelity, Schwab, and others have similar offerings. I also have some bucket mini portfolios that have S&P and Russel lead ETFs like VOO and VONG.

2. Short- and Long-Term Bonds

Asset Class Overview: Bonds serve as the ballast in my portfolio. They typically generate steadier returns compared to stocks, though yields and volatility can differ significantly based on whether the bonds are short- or long-term.

- Short-Term Bonds: Lower duration bonds aren’t as sensitive to interest rate changes, so they can provide a bit more stability during rate hikes.

- Long-Term Bonds: Offer higher potential yields, but their prices can fluctuate more in response to rate movements.

Diversification Benefit: In many market environments, bonds have shown lower correlation to stocks, which can help dampen overall portfolio swings and provide some income.

Risk & Correlation Notes:

- Risk: Credit risk (default risk) and interest rate risk can both affect bond prices.

- Correlation: Historically low correlation with equities, though all investments can correlate in extreme market conditions.

My Current Choices:

I use Vanguard short- and long-term bond index funds like BND. Others might prefer government bonds, TIPS, or corporate bonds depending on their risk tolerance. In some of my taxable accounts I prefer to hold the more tax-friendly VTEB.

3. Real Estate (REITs)

Asset Class Overview: Real Estate Investment Trusts (REITs) allow me to hold a stake in property markets without direct ownership. These can include commercial properties, apartment buildings, or even specialized niches like data centers.

Diversification Benefit: Real estate sometimes tracks different economic cycles than equities or bonds. Dividends from REITs can also offer a steady income stream, which I find appealing for long-term stability.

While I do hold some residential real estate (physical properties), I still prefer investing in REITs—particularly options like Vanguard’s VNQ—that provide access to commercial segments like cell towers, data centers, and self-storage. This broadens my overall real estate exposure beyond the housing market.

Risk & Correlation Notes:

- Risk: Tied to factors like interest rates, property market trends, and the health of specific real estate sectors.

- Correlation: Can correlate with equities in broad market downturns but otherwise can add diversity due to property-specific drivers.

My Current Choices:

I typically use broad REIT index ETF from Vanguard, VNQ . Specialized funds are also available if one wants specific real estate sectors. I like VNQ because it is weighted more on the sectors of commercial real estate that I otherwise don’t have exposure to, like Cell towers and Data centers.

4. Gold

Asset Class Overview: Gold is a longstanding store of value and a traditional hedge against economic uncertainty. While not always a sure bet, I find it can help reduce overall portfolio volatility when combined with stocks and bonds.

Diversification Benefit: Gold often moves independently of equities and bonds, which can offer relief when other markets struggle. Some view it as an inflation hedge and a “safe haven” in crisis periods, though its price can still be quite volatile.

Risk & Correlation Notes:

- Risk: Commodities in general can be unpredictable, influenced by global demand, sentiment, and currency movements.

- Correlation: Tends to be less correlated with stocks and bonds, potentially stabilizing returns when those assets falter.

My Current Choices:

I lean on a gold-focused ETF (like SPDR Gold Shares, GLD) for simplicity, though other funds like GLDM are options. Physical Gold is something I don’t prefer to avoid the needless hassle of storing and transacting (and incurring often heavy load costs).

5. Inflation-Protection Mix (Materials & Preferred Stocks)

Asset Class Overview: In this final bucket, I’m experimenting with a combination of commodities (like materials and energy) and preferred stocks. The idea is that commodities can provide an inflation hedge, while preferred stocks may offer a more stable income stream than common equities.

Diversification Benefit:

- Materials/Commodities: Typically behave differently than stocks or bonds, especially during inflationary periods.

- Preferred Stocks: Function as a hybrid asset class, potentially offering higher yields than many bonds but with different risk considerations.

Risk & Correlation Notes:

- Risk: Both commodities and preferred stocks can be volatile; commodity prices can swing on global supply/demand, while preferred stocks are sensitive to interest rates and issuer creditworthiness.

- Correlation: Commodities often post lower correlations with traditional equity/bond allocations. Preferreds can move in tandem with equities sometimes but may also serve as an alternative yield source.

My Current Approach:

I’m tinkering with funds like Invesco DB Commodity Index Tracking Fund (DBC) and preferred stock ETFs ( PFF). I’ll adjust as I learn more and see if there are better options.

Conclusion

The Golden Ration mix, truth be told, is a very conservative portfolio, ideal perhaps for the Preservation and Drawdown phase of the Fire life. But right now while I am in the Accumulation phase I still have very Growth focused Total Stock and S&P 500 weighted portfolio. I’m continuously refining my approach to maintain what I hope is a balanced and hands-off portfolio. While I’m working toward a “Golden Ratio” distribution, it’s an evolving experiment—particularly in gold, materials, and preferred stock allocations. I’m mindful of avoiding large tax events in my taxable accounts, so these changes happen gradually.

This strategy feels optimal to me at the moment, but it doesn’t mark the end of my exploration. I apply it fully in my after-tax brokerage accounts and adapt it where I can in my retirement plans, though available investment options sometimes dictate what I can do there.

Leave a comment